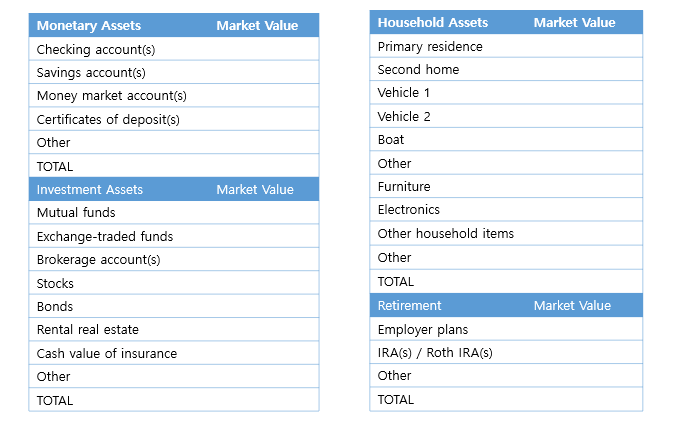

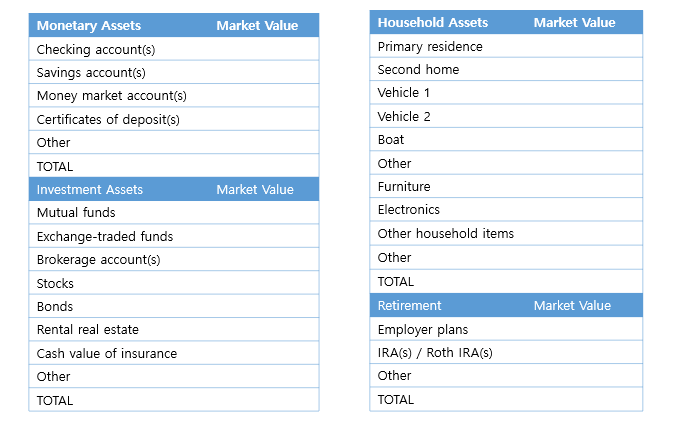

- A balance sheet helps to organize

- What you own - assets

- What you owe - liabilities

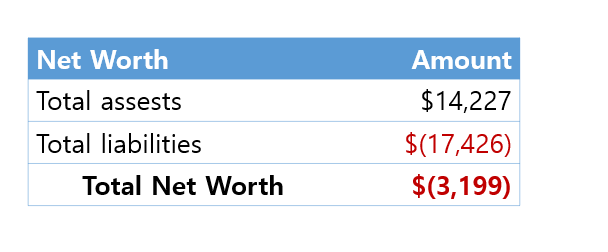

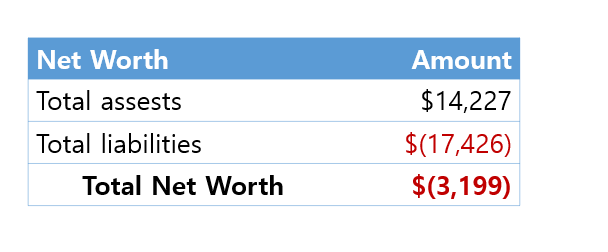

- Your assets minus your liabilities equal your net worth

- Assets−Liabilities=Net Worth

- Assets

- To determine if something is an asset, ask if you can legally sell it

- If you are able to legally sell it, then it is YOUR asset (i.e. your name is on the title of the car)

- If someone else owns it, then you don’t own the asset. This holds true for every potential asset. If you can sell it legally, you can list it on your balance sheet

- You want to strive for appreciating assets on your personal balance sheet, so assets that you can sell for more than you purchased them for

- Depreciating assets will generally resale for less than you purchased

- Liquidity refers to how quickly an asset can be converted to cash without penalties or significant reductions in value

- Fair market value is the price someone would realistically pay you for the asset

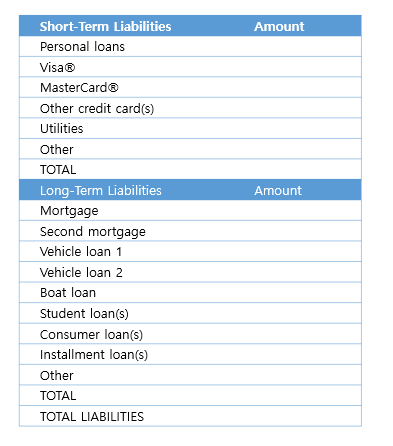

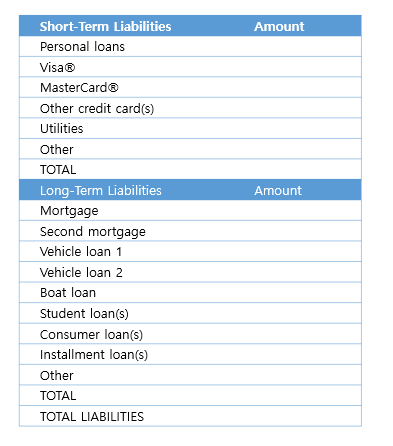

- Liabilities

- Liabilities are the debts that you owe to others and are generally listed on the balance sheet based on when the debt should be paid off

- Short-term liabilities such as utility bills, credit cards, short term loans etc. are due within a year

- Long-term liabilities have a longer repayment schedule and would include student loans and money borrowed to purchase a house (i.e. a mortgage)

- Net Worth

- Your net worth CAN and likely WILL be negative for a while

- Due to student loans and such

- The higher your net worth estimate, the better since banks etc. want to know it before giving a loan

- Those with positive net worth tend to get better loan deals

- Debt

- NOT ALL DEBT IS BAD DEBT

- Specifically, debt that is related to investments in your human capital are good debt

- i.e. paying for education or transportation to a job are good debts since they better your human capital

- Bad debt would be when you borrow money to buy something that will go down in value quickly or is consumed immediately

- This should be avoided at all costs

- Financial Ratios

- The current ratio is the proportion of current assets to current liabilities

- Shows how you are managing your short-term financial situation

- You should have at least 1inliquidsavingsforevery1 of short term debt

- The debt ratio is a broader measure of financial health

- Shows the proportion of total liabilities to total assets

- You should strive to limit debt to no more than 40% of the value of your assets (for 100inassetsyoushouldhave40 or less in total liabilities)