Your Starting Point

Financial literacy can mean many things:

- financial education

- being financially knowledgable

- background in economics

- streetwise consumer

- Realizing how personal and economic factors impact a household’s financial situation.

- Being able to apply basic time value of money concepts.

- Developing a balance sheet.

- Creating a budget and then tracking income and expenses on a monthly basis.

- Calculating and managing personal taxes.

- Knowing the costs and benefits of borrowing money.

- Determining basic saving and investing choices.

- Understanding the important role insurance plays in managing uncertainty.

- Planning for unforeseen life and death issues.

- Being able to navigate effectively through the financial marketplace. Your internal view of the financial world is based on

- Financial knowledge

- Financial risk tolerance

- Feelings of control

Financial knowledge

- The ability to understand and use personal finance information

- gaining financial knowledge will change your perceptions of finances

- “financial well being” is defined as having control over your current finances, feeling confident about your future goals, being able to absorb a financial shock, and having the financial freedom to make choices to enjoy life

Financial Risk Tolerance

- Your willingness to engage in financial endeavors that have uncertain outcomes

- People have varying degrees of risk tolerance

Feelings of Control

- The amount of control you feel when making financial decisions

- These relate to your self efficacy and confidence. You shouldn’t be overconfident, but not overwhelmed either Your current financial risk tolerance and feelings of control are a starting point and will change as you learn

Its better to manage your money well and increase your overall wealth over time versus just using your current income to take care of things. You don’t want to start a family only using your income, you want to do that with some amount of wealth saved and able to grow

- Financial literacy is one of the most important predictors of savings and investment success and overall well being

The Journey to Financial Well Being

- Key personal behaviors include

-

Self control

-

A desire to apply financial information to the management of your household

-

Continuing to learn about personal finance topics

-

Human Capital

- Human capital - your ability and willingness to work, learn, earn, and make wise decisions about how to save and invest money

- Social capital - how well you are able to form connections with other people Your social capital affects the value of your human capital, how much you earn over your working life

Human capital is most valuable asset when you’re young (Asset - something of value you own)

Ways to increase your human capital

- Your education and earnings

- Earnings indicate value of human capital in labor market

- Earnings are often associated with level of formal education

- Those with little or no college education are more likely to lose a job during a recession compared to those with a college degree or higher level of education

- Your health

- Healthy people work more hours over longer time

- Poor health may result in lower standard of living across life span

- Willingness to Relocate

- Those who are willing to relocate tend to earn a higher income over their lifetime financial journey because they can take advantage of location-specific higher income from their work, making it easier to save mor moeny ofver their work life

- i.e. oil prices are high so mechanics, construction workers, etc move to oil locations (North Dakota, Alaska, Texas…)

- Contiknuing education and skill development

- You can gain human capital through on the job training and professional education

- As the economy changes some forms of human capital become obsolete. For example, CAD changed the human capital for people who could make architectural drawings etc.

- Constantly improving your skills and learning can prevent this kind of thing from occurring to you

When you are young your human capital increases faster. Over time it will decrease, but you turn the human capital (mainly earnings) into wealth. Eventually you will have a lower amount of human capital but higher wealth to live off of so you don’t NEED the human capital anymore.

Social Capital

- Social capital is found in the relationships and connections between people

- Informal networks are the interpersonal relationships with family and close friends

- Provide encouragement and support

- Can help you find work, place to stay, lend money etc

- Important to keep these healthy

- Formal networks connect you with people in professional, recreational, leisure, and social communities

- Clubs, organizations, professional associations

- These help you advance in your career usually

The value of education

A college education usually leads to greater earnings overall. But the educational value is important to consider

- Educational value - the point where returns through job placements, income, and human capital outweigh the costs of school attendance

- School costs money, but at the end you can get a job where you earn MORE money

- Those with a professional degree will generally earn over 2 million more than those with only a high school diploma

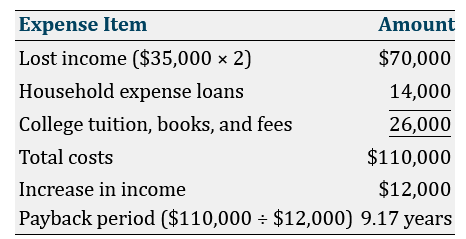

Payback period

See example below

So this person would go to college and eventually pay it back in 9 ish years. They would still have many years to use the additional income so its worth it.

So this person would go to college and eventually pay it back in 9 ish years. They would still have many years to use the additional income so its worth it.

Financial Risk Tolerance and Financial Goal Achievement

- Financial risk tolerance refers to your willingness to engage in a behavior that entails the possibility of a financial loss

- Willing to invest in stock market? if yes then you have higher risk tolerance etc etc

- Just because you like to take risks in other areas of life doesn’t mean you will be financially risky

- Relationship betwen wealth accumulation and risk tolerance is generally positive. You have to take some risks for greater returns, but you can take those risks smartly

- Playing lottery not a good investment risk

- Investing in mutual fund good investment risk