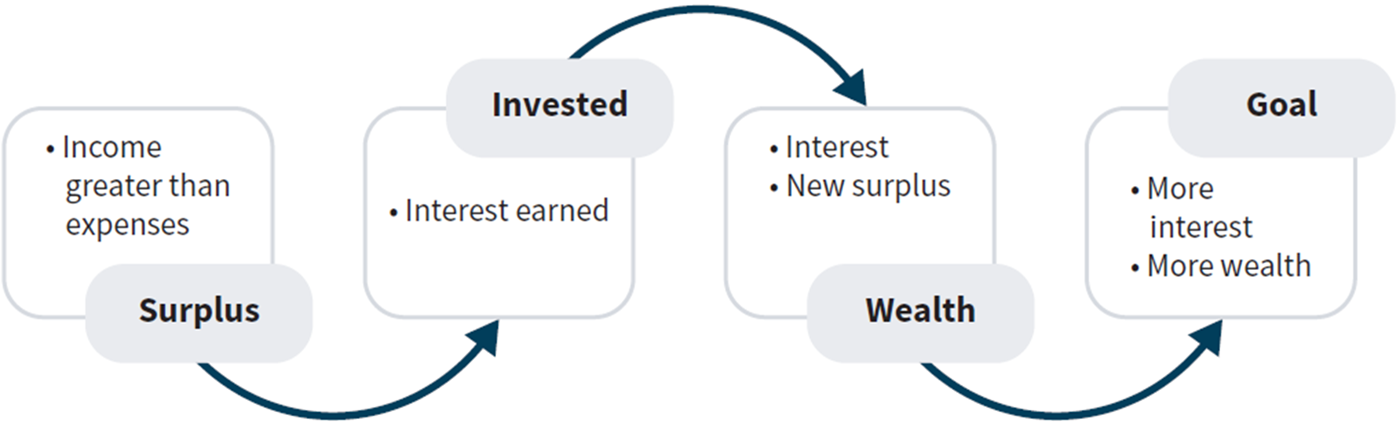

To accumulate wealth, you need to generate a surplus, which is simply the money left over after all your expenses have been paid

Turning incremental income surpluses into long-term wealth should be the goal. By incrementally earning interest on monthly surpluses, your wealth accumulates and also accelerates over time

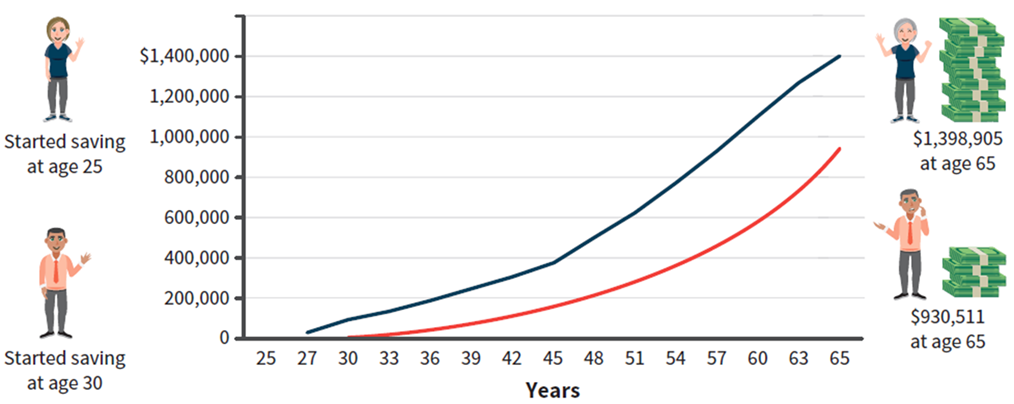

The earlier you begin saving, the better. In the graph below you can see how much of a difference five years can make.

The earlier you begin saving, the better. In the graph below you can see how much of a difference five years can make.

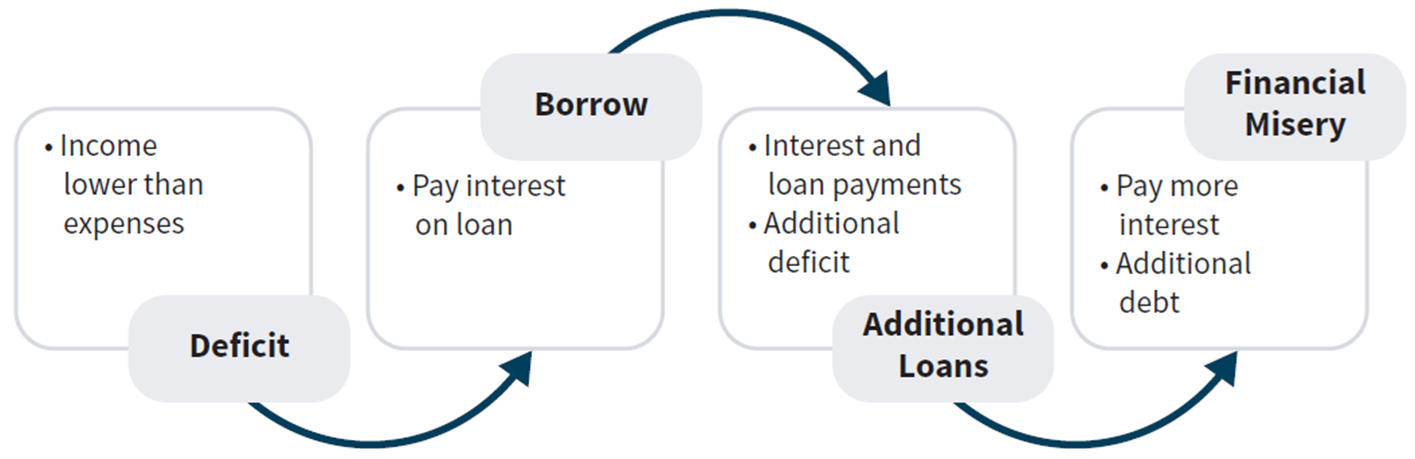

The opposite side of a surplus is deficit. Continuously incurring a deficit is unsustainable and will lead to financial stress. You should keep emergency savings in place to cover deficits when they occasionally occur.

Targeted Savings Ratio - Indicates the percentage of income that you are actively saving, as calculated by the following formula: Targeted Savings Rate - the savings ratio over a specific time period, for example if you are:

- < 30 your target should be to save 12% toward retirement

- 30 to 40 your target savings rate should be at least 15%

-

40, you will need a target retirement savings rate of 20% per year for each year until age 65 You should always try to repay debt by increasing your income. Incurring a lot of debt and keeping it is bad. You want to keep your total debt-to-income ratio less than 36%