Six steps to a financial plan

- What is your goal?

- What is your starting point?

- What is your financial score?

- What is your financial capacity?

- How realistic is your time horizon?

- Formalize and implement your financial plan!

Six Steps

- Set a Goal

- Think about the goal from the framework of SMART goals. Specific, Measurable, Attainable, Realistic, and Timely

- “To save 250,000 house”

- Know starting point

- Take an inventory of your human and financial capital and personal attributes and attitudes

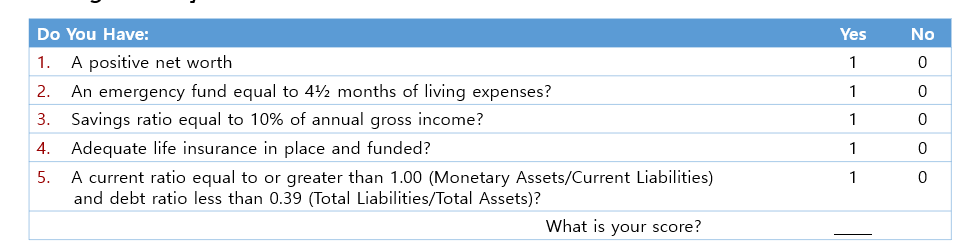

- Financial Score

- A financial score provides a realistic understanding of your risk tolerance, financial knowledge, and feelings of control

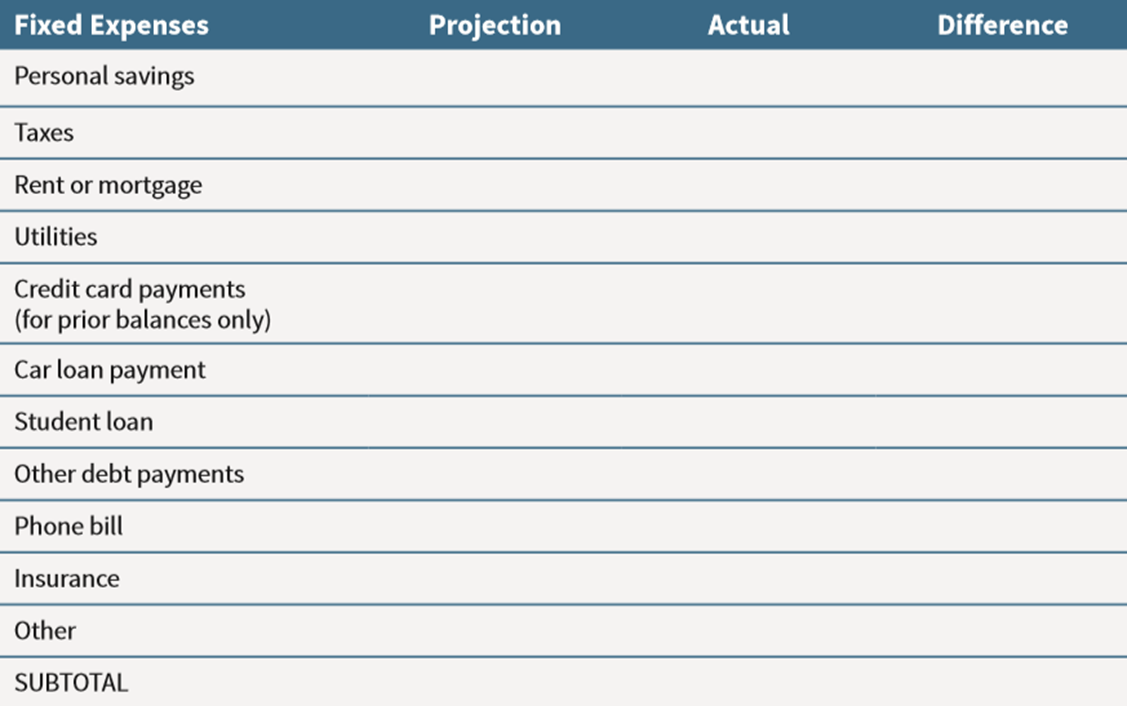

- Financial Capacity

- The ability to keep moving forward toward goal achievement even if you face a few financial challenges or emergencies along the way

- Time Horizon

- Determine if the time horizon is realistic

- The success or failure of a financial plan comes down to one thing, balancing risk and return in savings and investments

- Time value of money calculations come in handy

- Implement

- Without proper implementation you’ll find it difficult to achieve your financial goals

- The success of any journey begins with thorough planning