Taxes are financial obligations imposed on individuals and businesses by government entities. Governments use taxes to:

- build infrastructure

- provide social welfare

- pay for national defense

- provide other public services

- encourage economic activity In any given year, nearly all working adults pay the following types of taxes

- Federal Income Taxes

- taxes on money earned

- State income taxes (where applicable)

- taxes on money earned

- Payroll taxes

- taxes imposed on the American labor force for the future privilege of future social security retirement payments, Medicare, and unemployment insurance if you were to lose your job to no fault of your own

- Sales taxes

- the taxes aplied to products you purchase

- Property taxes

- taxes on private ownership of real estate

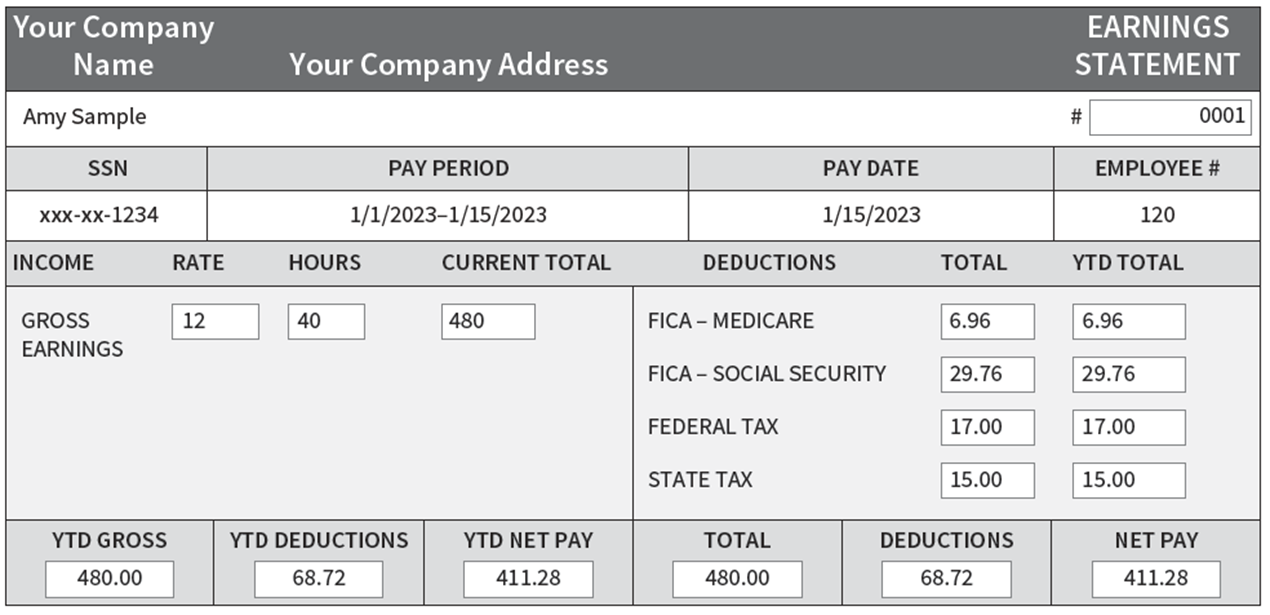

For federal and state income taxes, the tax is taken out of your paycheck in withholdings. Your Gross pay is the total amount earned before taxes and other deductions. Your Net pay is Gross pay minus withholdings

- taxes on private ownership of real estate

For federal and state income taxes, the tax is taken out of your paycheck in withholdings. Your Gross pay is the total amount earned before taxes and other deductions. Your Net pay is Gross pay minus withholdings

The payroll tax aka Federal Insurance Contributions Act (FICA) tax is exclusively to pay for two government programs:

- Social security

- Medicare

Typical pay stub

Typical pay stub

Sales taxes are imposed by state and local governments on the sale of certain items goods or services. They’re paid when you buy something. These taxes are determined based on two factors, the tax base is the amount of money that will be taxed. The tax rate is used to calculate the amount of tax owned and is usually a percentage

Lastly, property taxes are assessed based on the value of property you own.

- They can vary by state and are most often assessed by the city or county

- Often referred to as ad valorem taxes, which means “according to value”

- Based on the current assessed value of the property

- Determined by each taxing authority The Internal Revenue Service (IRS) within the Department of the Treasurey is charged with collecting taxes and enforcing tax laws.