Five steps to a budget

- Use the SMART approach to goal devleopment. Set and know what your goals are

- Know where your money is coming from (income)

- Know where your money is going (spending)

- A budget is a financial tool that helps regulate how quickly and in what ways your money is going to be used so that you can stay focused on accomplishing your goals

- At the end of the month, evaluate what happened Three main sections to a budget

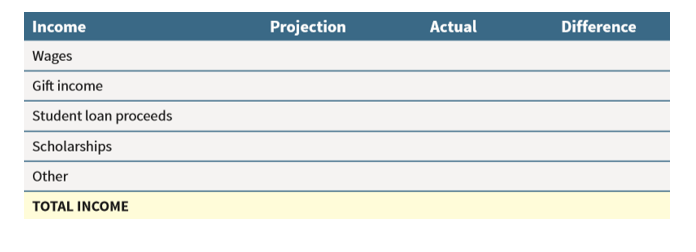

- Income

- All resources that can be spent or saved, such as wages or salaries, interest earned, and allowances

- Expenses

- Everything, EVERYTHING, that you spend money on

- Surplus (deficit) estimate

- A surplus means that you have planned well and have your money working for you

- A deficit indicates that your expenses exceed your income

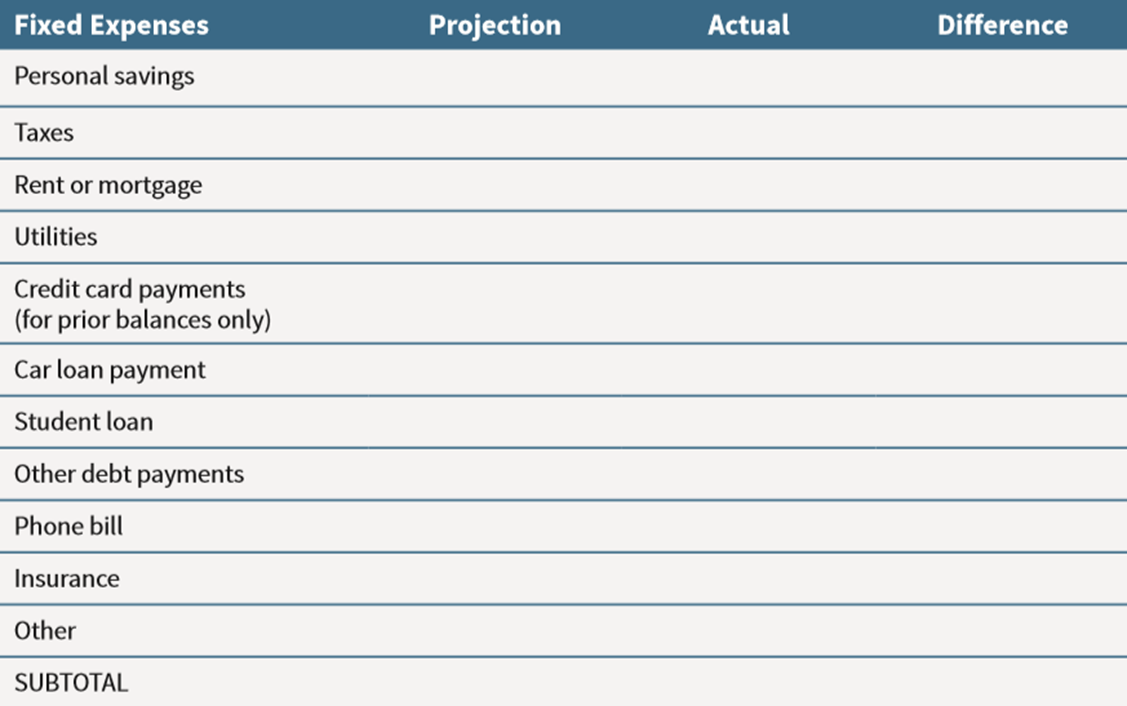

- An example budget table. You might include a projection of what each thing is, the actual value, and the difference at the end of the month

- Expenses include everything you spend money on

- Detail is important, so it may be useful to split things like utilities into more specifics like water and electricity

- Fixed expenses happen every month in fairly equal amounts such as loan payments, rent, insurance etc. Consider these your “needs”

- Saving money should also become a FIXED REGULAR EXPENSE in your budget. Just like buying food or paying utilities

- Ideally you should strive to save at least 12% of your gross income as a long term savings

- Variable Expenses are usually listed below fixed expenses because you may add or delete items over time

- For example, these are the expenses you could “do without” if the budget is a little short

- Luxuries, wants etc.

- The difference between projections and actuals can often be illimunating

- Lastly your budget should have a summary

- You should be able to anticipate whether your income will exceed or fall below your estimate of expenses

- Surplus good, deficit bad

Financial Ratios

- Just like your Balance Sheets have financial ratios, so too will the budget

- Savings Ratio

- The savings ratio indicates the percentage of money that you are setting aside on a regular basis

- (Household Savings + Employer contributions to retirement plan)/Gross income

- Strive to save at least 12% of your gross income

- Emergency Fund Ratio

- The emergency fund ratio indicates whether you have sufficient resources available in case of an emergency

- You should have resources to cover 3 to 6 months of necessary expenses

- Necessary expenses = all of your expenses minus taxes, savings, and nonessential expenses

- Consumer Debt to Income Ratio

- Indicates what percentage of your income you are using to pay debt payments (credit cards, personal loans etc.)

- Total Consumer Debt Payments/Gross Income

- Avoid spending more than 15% of your income on consumer debt payments

- Total Debt to INcome Ratio

- Indicates what percentage of your income you are using to pay ALL of your debts (consumer debt plus mortgage plus student loans)

- Total Debt Payments/Gross Income * 100

- No more than 36% of income should be used for debt payments